Trust is a function of (Customer-centric Process, Speed, and Personalization)

Case Studies

- AI CRM @ Insuretech

- Dynamic Lead Scoring and Optimized Routing

- Enhancing Call Quality with AI Audit System

- Comprehensive Rejection Management System

- Fraud Detection

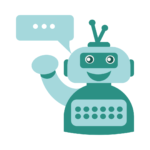

At the Singapore-based Insuretech, we developed a sophisticated AI-driven CRM system from the ground up, designed to redefine customer interactions and optimize operational efficiency. Key features include:

- Automated Lead Management: Streamlined lead nurturing processes powered by dynamic lead scoring and behavior analysis.

- WhatsApp Integration: Seamless customer communication, supported by textual analysis for intent detection and prioritized actions.

- Speech-to-Text (S2T) Technology: Multi-language transcription of customer calls for post-call analysis.

- Intent Analysis: AI-driven systems to decipher caller intent and categorize interactions.

- Sentiment Analysis: Real-time emotional analysis of conversations to gauge customer satisfaction and mood.

- Next-Step Prediction: Predictive analytics to recommend follow-up actions, ensuring proactive engagement strategies.

- Renewal Workflows & Reminders: Automated workflows to ensure timely renewals and sustained customer engagement.

- Advanced Models for Lead Prioritization: Intelligent systems for auto-prioritizing business books and optimizing calling efforts.

- Product Analytics & Performance: High-uptime (>98.5%) solutions with real-time feedback from 200+ agents for continuous improvement.

This AI-powered CRM revolutionized Insuretech’s customer experience by enabling smarter decision-making, improving call outcomes, and driving exceptional business performance.

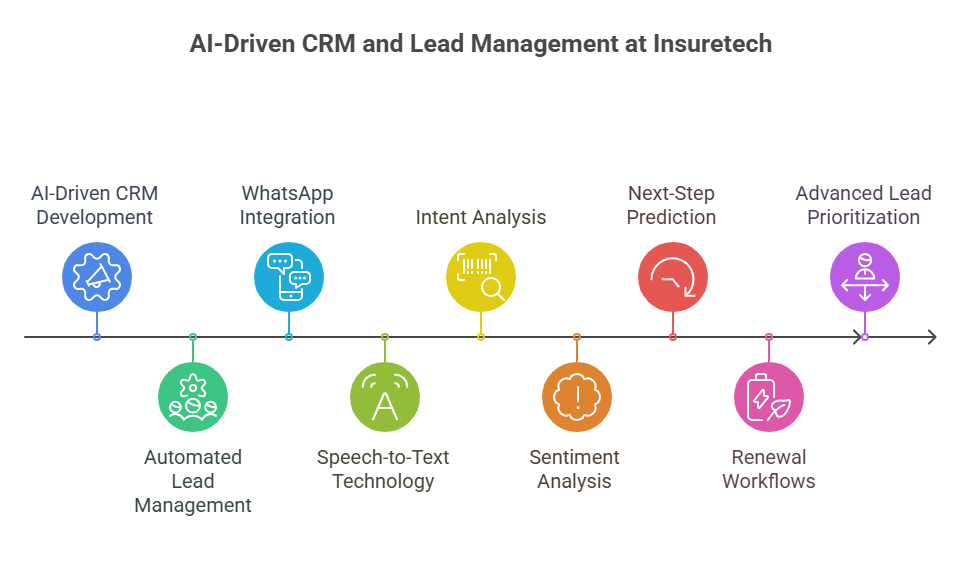

At Singapore-based Insurtech & US-based Mortgage companies, we implemented the below-mentioned strategies:

Lead Scoring Redefined:

Dynamic lead scoring empowers businesses with an advanced mechanism to evaluate and prioritize leads, especially in industries with longer sales cycles like insurance and mortgage. By identifying and focusing on high-conversion prospects, this approach boosts efficiency and results.

From Static to Dynamic:

Traditional lead-scoring methods fall short of capturing real-time changes in lead behavior. Dynamic scoring evolves with every interaction—whether online, human, or automated—allowing businesses to reassess and reprioritize leads based on updated context, interests, and engagement patterns. This adaptability ensures no opportunity is missed.

Contextual Insights for Conversion:

By analyzing the intent behind each interaction, dynamic scoring provides actionable insights into the next best steps for both agents and users. This context-driven approach maximizes the probability of successful conversions while enhancing the overall customer journey.

Smart Routing for Maximum Impact:

Routing strategies are elevated by integrating lead and agent scoring systems, surpassing traditional methods like round-robin or FCFS. High-value or urgent leads are flagged using triggers from past conversations, enabling escalations to be addressed promptly. This ensures critical leads are handled by the most suitable agents, optimizing outcomes and minimizing risks.

Dynamic lead scoring and routing not only streamline workflows but also transform lead management into a strategic advantage, driving higher conversions and superior customer satisfaction.

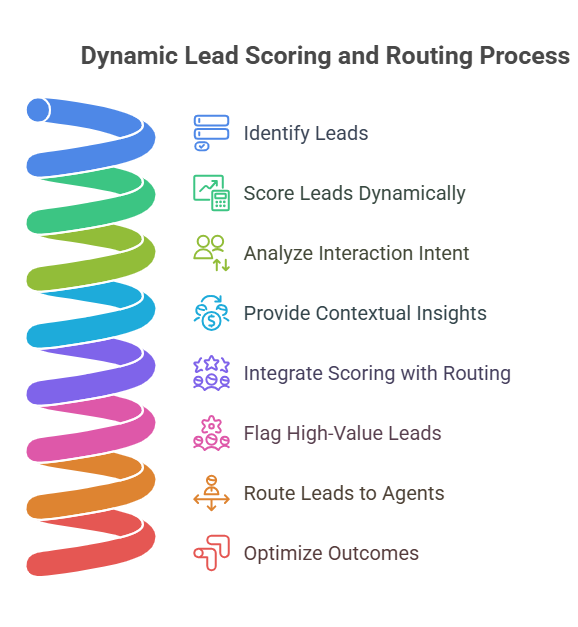

Agent Call Audits @ Insurtech Firms based out in India and Indonesia

Enhancing Call Quality with Precision:

We developed a robust Agent Call Audit System to elevate the quality and effectiveness of agent interactions. This system records agent calls and analyzes a subset monthly or quarterly to ensure adherence to calling scripts and improve overall performance.

AI-Powered Call Analysis:

Each call undergoes transcription validation, scoring the agent’s adherence to the script, tone, and language accuracy. The system evaluates deviations, analyzing user sentiment in response to off-script moments. This holistic approach grade calls, identifying areas for improvement.

Targeted Skill Enhancement:

Agents who fail to meet performance benchmarks are automatically assigned quizzes tailored to their specific needs. These quizzes, derived from a question bank curated from top-performing agents, focus on critical skills and scenarios. Agents must achieve a revision score of 80% or higher to pass, ensuring they are equipped for excellence in future audits.

Empowering Agents for Success:

This system not only measures performance but actively drives improvement, creating a cycle of continuous learning. By leveraging insights from top-performing peers, agents gain actionable feedback, refine their skills, and consistently enhance their call audit scores.

Our solution ensures every call is a step toward better customer experiences and higher operational standards.

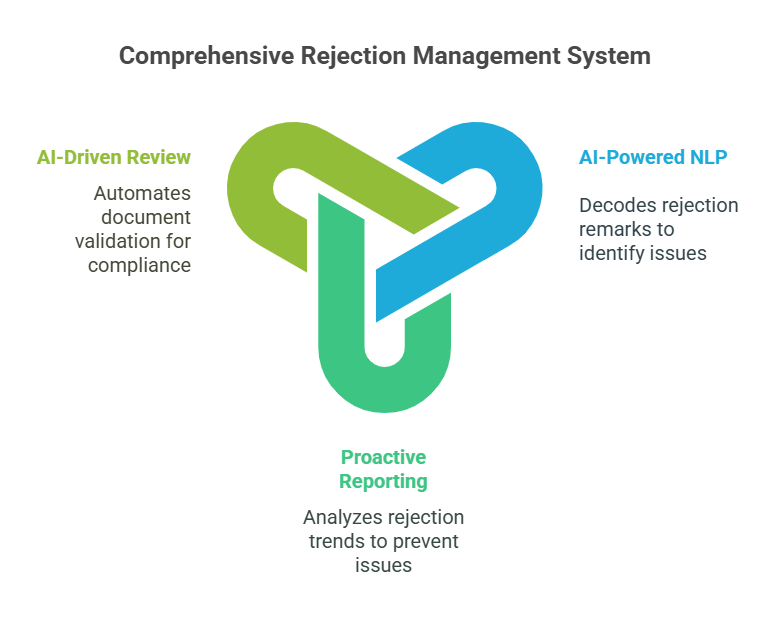

Transforming Rejections into Opportunities: AI-Driven Solutions for Insurtech

We developed a cutting-edge Rejection Reason Analysis and Actionable Recommendation System to address post-application rejections at the insurer level. These rejections often stem from incomplete or non-compliant documentation and ambiguous insurer remarks. Here’s how we tackled this challenge:

AI-Powered NLP for Rejection Analysis:

We implemented a Natural Language Processing (NLP) system to decode and map insurer-provided rejection remarks to specific issues in the submitted proposal forms. This helped agents identify the root causes of rejections instantly and provided clear, actionable next steps to resolve them.

Proactive Rejection Prevention with Reporting Insights:

Our solution included advanced reporting capabilities that aggregated and analyzed rejection trends across insurers. By identifying high-focus rejection areas for different insurance partners, we developed an Internal Audit and Review System. This system preemptively flagged potential issues before submission, ensuring that applications met insurer expectations. This reduced rejection rates dramatically, from 17% to under 5% within 2-3 months.

AI-Driven Pre-Submission Review:

We built an automated review system powered by OCR (Optical Character Recognition) and Speech-to-Text (STT) technologies to further streamline the process. This system validated key documents such as proposal forms, medical video consultations, and income proofs. It flagged inconsistencies or missing information, ensuring applications were clean and compliant before reaching manual review.

Business Impact:

- Increased Approval Rates: The system significantly reduced application rejections, boosting customer satisfaction and operational efficiency.

- Empowered Agents: With actionable insights at their fingertips, agents could resolve issues faster, improving conversion rates.

- Data-Driven Decision-Making: Robust reporting allowed insurers to align better with partner priorities and optimize workflows.

This AI-driven approach transformed rejection management into an opportunity for improved compliance, streamlined operations, and enhanced customer experience.

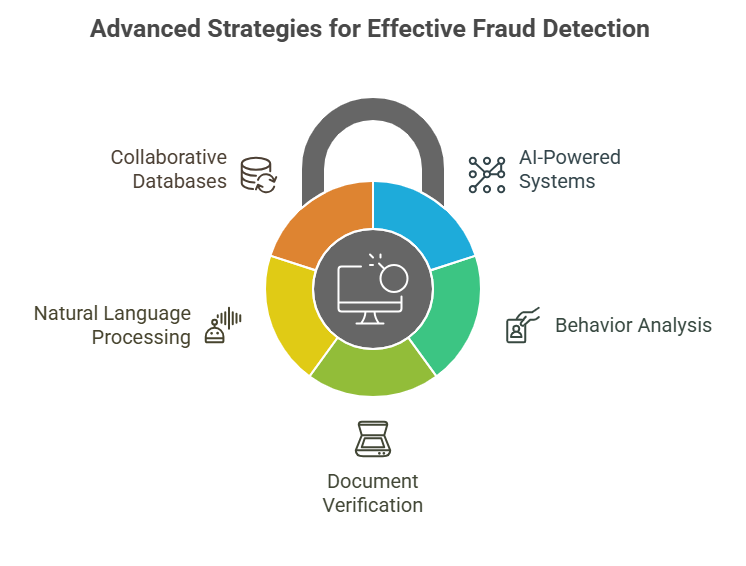

Fraud Detection @ Insuretech and Financial Systems

Fraud detection in the insurtech and financial sectors is a critical component of risk management. With evolving fraud techniques, leveraging advanced technologies like AI and machine learning has become essential to ensure compliance, safeguard assets, and maintain trust. Here’s how fraud detection is transforming these industries:

AI-Powered Fraud Detection Systems

AI and machine learning algorithms play a pivotal role in detecting anomalies in vast datasets. These systems analyze patterns and flag deviations that suggest fraudulent activities. For example:

- Claims Fraud: AI models identify suspicious patterns in insurance claims, such as exaggerated damages or repeated claims for similar events.

- Transaction Monitoring: In financial systems, real-time analysis of transactions helps detect irregularities like account takeovers, identity theft, or money laundering.

Behavior Analysis

Behavioral analytics adds a layer of precision by monitoring user behavior across digital platforms. For example:

- Customer Profiles: Establishing baseline behaviors for customers and flagging deviations, such as accessing accounts from unusual locations or devices.

- Agent Fraud: Detecting unethical agent activities, like creating false policies or misreporting claims, asking users to pay and then cancel, and long calls to show usage in the system.

Document Verification and Validation

Fraudulent document submissions, a common challenge in insurance and lending, are mitigated using:

- Optical Character Recognition (OCR): Extracts data from documents such as ID proofs, income statements, or medical records for validation.

- Deep Learning Models: Authenticate documents by identifying forgeries or tampering, such as mismatched fonts or photoshopped images.

Natural Language Processing (NLP)

NLP systems are used to analyze written and verbal communication, such as:

- Claims Processing: Analyzing the text in claims forms for inconsistencies.

- Voice Analytics: In insurance, NLP in speech analysis during customer calls can detect stress or hesitation, signaling potential deception.

Collaborative Databases

Fraud detection systems often integrate with industry databases to cross-check applications, claims, and transactions. For instance:

- Blacklists and Watchlists: Verifying customers or transactions against known fraud databases.

- Blockchain Technology: Secure, immutable ledgers provide transparency and traceability in transactions and claims.

Impact

These systems significantly reduce fraudulent activities, enhance operational efficiency, and increase customer trust. For example:

- Insurers can lower claim rejection rates by preemptively identifying high-risk submissions.

- Financial institutions mitigate risks associated with money laundering and fraud, ensuring compliance with regulations like AML (Anti-Money Laundering) and KYC (Know Your Customer).

Fraud detection in insurtech and finance is an ongoing battle requiring advanced, adaptable technologies to keep pace with sophisticated fraud schemes. By leveraging AI, behavioral analytics, and document validation, companies can build robust, secure, and transparent ecosystems.